Loans that Accept Everyone: Access Cash Instantly with No Wait, Even with Poor Credit

In today’s fast-paced world, financial emergencies can arise at any moment. Whether it’s an unexpected medical bill, car repair, or simply making ends meet before payday, having access to quick cash is crucial. For individuals with poor credit, finding a reliable lending solution can feel like an uphill battle. However, the good news is that there are Loans that Accept Everyone, designed to provide financial assistance regardless of your credit history. In this article, we’ll explore how these loans work, their benefits, and how you can access cash instantly with no wait.

What Are Loans that Accept Everyone?

Loans that Accept Everyone are financial products specifically tailored to cater to individuals with less-than-perfect credit scores. Unlike traditional loans, which often require a high credit score and extensive documentation, these loans focus on your ability to repay rather than your past financial mistakes. This inclusivity makes them an ideal solution for those who have been turned down by banks or other lending institutions.

Key Features of Loans that Accept Everyone

1.No Credit Check or Minimal Credit Requirements: One of the standout features of Loans that Accept Everyone is that they often require no credit check or have very lenient credit requirements. This means that even if you have a poor credit score, you can still qualify for the loan.

2.Fast Approval Process: Time is of the essence when you’re in a financial bind. These loans are designed to provide quick approvals, often within minutes, so you can access the funds you need without delay.

3.Instant Cash Disbursement: Once approved, the funds are typically disbursed instantly or within 24 hours. This makes Loans that Accept Everyone a great option for urgent financial needs.

4.Flexible Repayment Terms: Many lenders offering these loans provide flexible repayment options, allowing you to choose a plan that fits your budget and financial situation.

5.Accessible Online: The application process for Loans that Accept Everyone is usually straightforward and can be completed online. This eliminates the need for in-person visits to a bank or lending institution, saving you time and effort.

Benefits of Loans that Accept Everyone

- Inclusivity: As the name suggests, these loans are designed to accept everyone, regardless of their credit history. This inclusivity ensures that more people have access to financial assistance when they need it most.

- Convenience: The online application process and fast approval times make these loans incredibly convenient, especially for those who need cash quickly.

- Improved Financial Flexibility: By providing access to funds when you need them, Loans that Accept Everyone can help you manage unexpected expenses without derailing your financial stability.

- Opportunity to Rebuild Credit: Some lenders report your repayment activity to credit bureaus, which can help you rebuild your credit score over time.

How to Apply for Loans that Accept Everyone

Applying for Loans that Accept Everyone is a simple and straightforward process. Here’s a step-by-step guide:

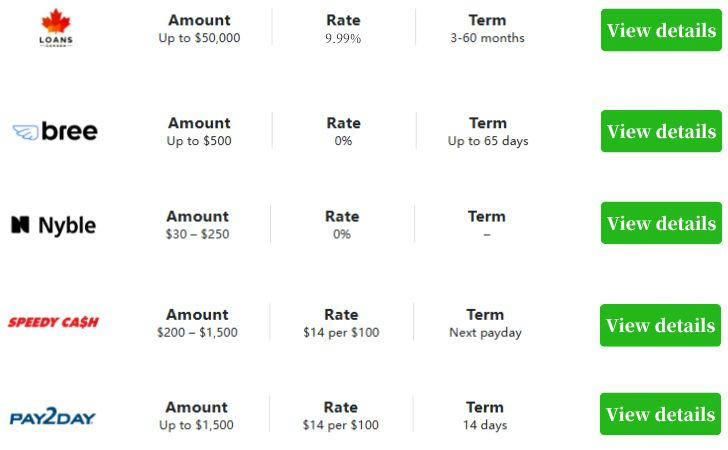

1.Research Lenders: Start by researching reputable lenders that offer Loans that Accept Everyone. Look for reviews, ratings, and customer feedback to ensure you’re dealing with a trustworthy provider.

2.Check Eligibility Requirements: While these loans are designed to be inclusive, some lenders may still have basic eligibility criteria, such as age, income, or residency status. Make sure you meet these requirements before applying.

3.Fill Out the Application: Complete the online application form, providing the necessary personal and financial information. This typically includes your name, address, income details, and bank account information.

4.Submit Documentation: Some lenders may require additional documentation, such as proof of income or identification. Be prepared to upload these documents if needed.

5.Wait for Approval: Once you’ve submitted your application, the lender will review it and provide a decision, often within minutes.

6.Receive Funds: If approved, the funds will be disbursed to your bank account instantly or within 24 hours.

Tips for Choosing the Right Loan

- Compare Interest Rates: While Loans that Accept Everyone are designed to be accessible, interest rates can vary significantly between lenders. Be sure to compare rates to find the most affordable option.

- Read the Fine Print: Before signing any agreement, carefully review the terms and conditions, including repayment terms, fees, and any penalties for late payments.

- Avoid Predatory Lenders: Be cautious of lenders who charge exorbitant fees or have unclear terms. Stick to reputable providers with transparent lending practices.

Conclusion

Loans that Accept Everyone are a lifeline for individuals with poor credit who need quick access to cash. With their inclusive eligibility criteria, fast approval process, and instant disbursement, these loans provide a practical solution for managing financial emergencies. By choosing the right lender and understanding the terms, you can secure the funds you need without the stress of traditional lending barriers. Whether you’re facing an unexpected expense or simply need a little extra cash to get by, Loans that Accept Everyone offer a reliable and accessible option for all.