Blacklist Loans: Access Cash Instantly with No Wait, Even with Poor Credit

In today’s fast-paced world, unexpected expenses like medical bills, car repairs, or home emergencies can strike at any time. For those with poor credit or blacklisted by traditional lenders, securing quick cash can seem impossible. Blacklist loans provide a lifeline, offering immediate financial assistance without the lengthy approval processes of conventional banks. Designed for individuals with less-than-perfect credit, these loans ensure that urgent financial needs are met swiftly and efficiently.

🔹What Are Blacklist Loans?

Blacklist loans are a financial product designed for individuals who have been "blacklisted" due to a poor credit history. Being blacklisted usually means you have a low credit score and a history of late payments, defaults, or even bankruptcy. However, blacklist loans are offered by alternative lenders who focus more on your current financial situation and repayment ability rather than your credit score. They offer a significant opportunity for those who have been rejected by traditional financial institutions.

🔹How Do Blacklist Loans Work?

Blacklist loans are designed to be quick and accessible. Here’s how they typically work:

- No Credit Check: Unlike traditional loans, blacklist loans do not require a hard credit check. This means your credit history won’t be scrutinized, making it easier for you to qualify.

- Fast Approval: One of the biggest advantages of blacklist loans is the speed of approval. Many lenders offer instant decisions, allowing you to access funds within hours or a single business day.

- Flexible Repayment Terms: Depending on the lender, you may have the option to repay the loan in installments or as a lump sum. This flexibility can help you manage your finances more effectively.

- Small to Moderate Loan Amounts: Blacklist loans typically range from $100 to $15,000, depending on the lender and your financial situation. While these amounts may be smaller than traditional loans, they are often sufficient to cover urgent expenses.

🔹Benefits of Blacklist Loans

- Accessible to Blacklisted Individuals: The primary benefit of blacklist loans is that they are available to individuals with poor credit or those who have been blacklisted by traditional lenders.

- Quick Access to Cash: When you’re facing a financial emergency, time is of the essence. Blacklist loans provide fast access to funds, often within 24 hours of approval.

- No Collateral Required: Most blacklist loans are unsecured, meaning you don’t need to put up any assets as collateral to qualify.

- Improve Your Credit Score: By repaying your blacklist loan on time, you can demonstrate financial responsibility, which may help improve your credit score over time.

🔹How to Apply for a Blacklist Loan

Applying for a blacklist loan is a straightforward process. Here’s a step-by-step guide:

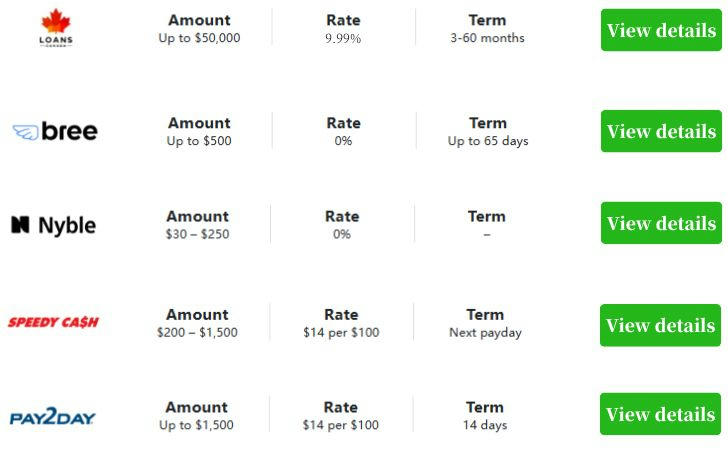

1.Research Lenders: Start by researching reputable lenders that offer blacklist loans. Look for lenders with positive reviews, transparent terms, and fair interest rates.

2.Check Eligibility Requirements: While blacklist loans don’t require a credit check, lenders may have other eligibility criteria, such as a minimum income or employment status.

3.Submit Your Application: Complete the online application form, providing the necessary information, such as your personal details, income, and banking information.

4.Receive Approval: If approved, you’ll receive a loan agreement outlining the terms and conditions. Be sure to read this carefully before accepting the loan.

5.Receive Funds: Once you accept the loan agreement, the funds will typically be deposited into your bank account within 24 hours.

Frequent Blacklist Loan FAQ

How do I choose a reliable blacklist loan lender?

To find a trustworthy lender, consider the following tips:

- Check reviews and ratings: Look for lenders with positive customer feedback and a good reputation.

- Compare interest rates and fees: Choose a lender with transparent and competitive rates.

- Verify licensing: Ensure the lender is licensed to operate in your region.

- Read the fine print: Carefully review the loan agreement to avoid hidden fees or unfavorable terms.

What happens if I can’t repay my blacklist loan?

If you’re unable to repay your blacklist loan, contact your lender immediately to discuss your options. Some lenders may offer an extension or a revised repayment plan. However, failing to repay the loan can result in additional fees, higher interest rates, and damage to your credit score.

Can I improve my credit score with a blacklist loan?

Yes, if you repay your blacklist loan on time, it can demonstrate financial responsibility and potentially improve your credit score over time. However, this only applies if the lender reports your repayment activity to credit bureaus.